san francisco sales tax rate july 2021

The San Francisco Tourism Improvement District sales tax has been changed within the last year. The County sales tax rate is 025.

Understanding California S Sales Tax

The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in San Francisco.

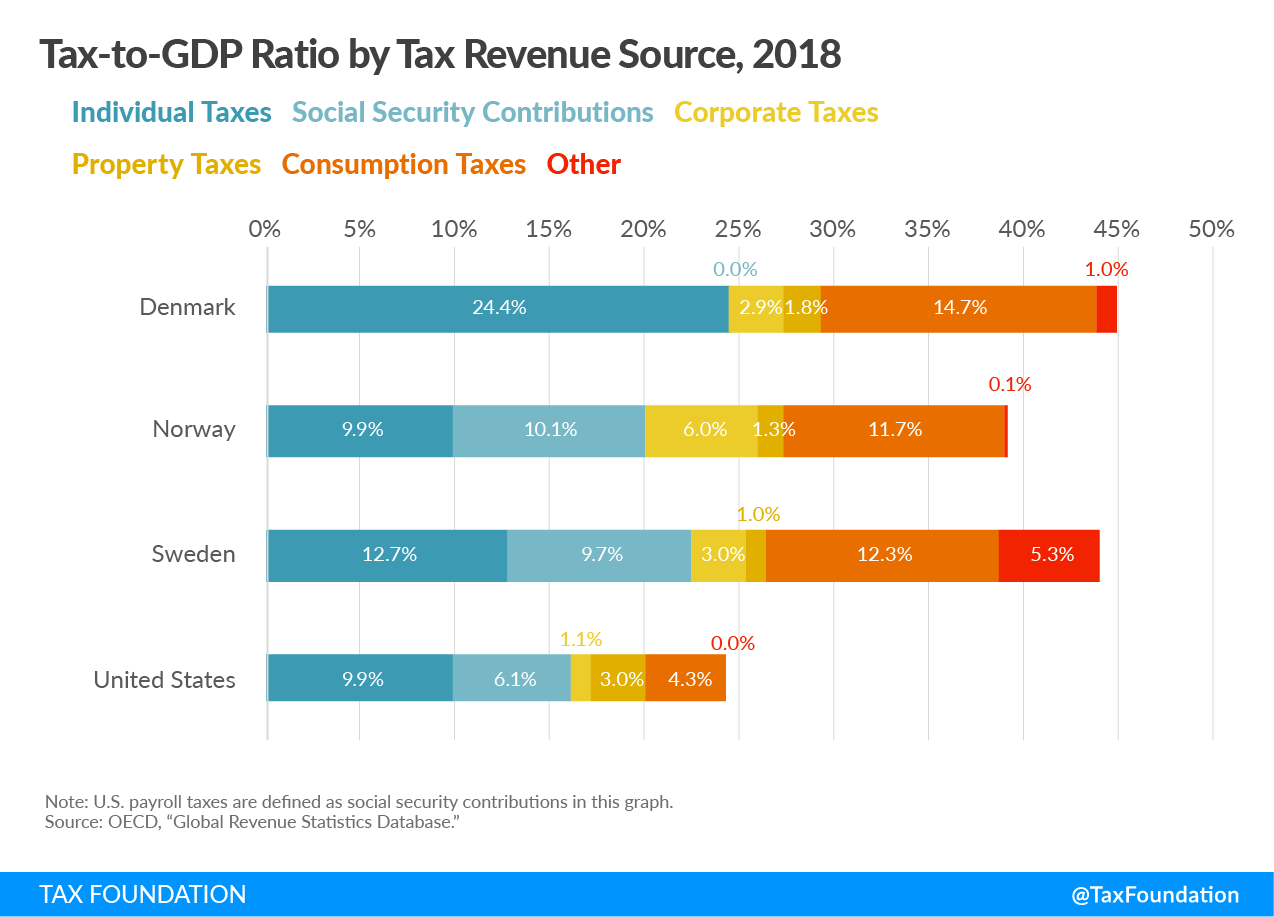

. The California state sales tax rate is currently 6. CA Sales Tax Rate. Most of the raises were approved by California voters.

To review the rules in California visit our state-by-state guide. Sales Tax Rates Rise Up To 1075 In Alameda County. 5192021 120245 PM.

SAN FRANCISCO KRON Several cities will have a Sales Use tax hike go into effect on July 1. Sales Prices Trends first appeared on Paragon Specific. Indiana Mississippi Rhode Island and Tennessee.

The minimum combined sales tax rate for San Francisco California is 85. San francisco sales tax rate july 2021 Monday March 14 2022 Edit. The 2018 United States Supreme Court decision in South Dakota v.

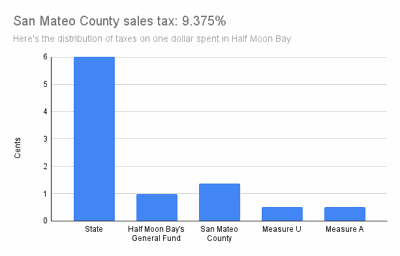

ALAMEDA COUNTY KPIX 5. How much is sales tax in San Francisco. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July.

There is no applicable city tax. L-805 New Sales and Use Tax Rates Operative July 1 2021 Author. California Department of Tax and Fee Administration Subject.

The County sales tax rate is. San Francisco CA Sales Tax Rate. 2021 State Sales Tax Rates.

Fast Easy Tax Solutions. The Sales and Use tax is rising across California including in San Francisco County. By Teresa Farnsworth June 25 2021.

The current total local sales tax rate in San Francisco CA is 8625. San Francisco County CA Sales Tax Rate. The secured property tax rate for Fiscal Year 2021-22 is 118248499.

New Sales and Use Tax Rates Operative July 1 2021 Created Date. Please consult your local tax authority for specific details. The minimum combined 2021 sales tax rate for San Francisco County California is 863.

California has the highest state-level sales tax rate at 725 percent. This is the total of state county and city sales tax rates. The post San Francisco July 2021 Report.

It was raised 0125 from 975 to 9875 in July 2021. 2 Four states tie for the second-highest statewide rate at 7 percent. The new rates will be displayed on July 1 2021.

The current total local sales tax rate in San Francisco County CA is 8625. San Francisco CA Sales Tax Rate. July 1 2021 701 PM CBS San Francisco.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. For more information visit our ongoing coverage of the virus and its impact on sales tax compliance. Wayfair Inc affect California.

The California sales tax rate is currently 6. The San Francisco County sales tax rate is. The total sales tax rate in any given location can be broken down into state county city and special district rates.

CA Sales Tax Rate. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and raised 0125 from 85 to 8625 in July 2021. The minimum combined 2022 sales tax rate for San.

54 of MLS sales ere condos 38 were houses 6 TICs 1 co-ops and 1 townhouses. The lowest non-zero state-level sales tax is in Colorado which has a. Approximately 3885 MLS sales occurred in the six months through mid-June 2021.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. Ad Find Out Sales Tax Rates For Free. All rates are General Retail Sales or Use tax rates and do not reflect special category products or particular industry rates.

San Francisco CA Sales Tax Rate San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco CA is 8625. Of 2017 Saw People In Expensive High Tax Coastal Markets Like San Francisco New York Los Angeles Sear Los Angeles San Francisco New York. This is the total of state and county sales tax rates.

The December 2020 total local sales tax rate was 8500. 2009 Aprilia Sportcity 125 Motorcycles For Sale Aprilia Motorcycle. The San Francisco County sales tax rate is 025.

Has impacted many state nexus laws and sales tax collection requirements. In San Francisco the tax rate will rise from 85 to 8625. 1400 Van Ness Avenue San Francisco CA Lic 01332687.

July 1 2021 Sales Tax Rate Changes.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California City County Sales Use Tax Rates

Bernie Sanders Tax Plans Proposals Tax Foundation

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Which States Have The Highest Income Tax Rates Fedsmith Com

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Sales Tax Small Business Guide Truic

2022 Federal State Payroll Tax Rates For Employers

California Sales Use Tax Guide Avalara

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Gas Taxes Increasing In The Bay Area And California

California Sales Tax Information Sales Tax Rates And Deadlines

California Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

Understanding California S Sales Tax

Opinion Why California Worries Conservatives The New York Times